Aenean ornare velit lacus, ac varius enim lorem ullamcorper dolore aliquam.

As the tax filing season approaches, many salaried employees find it challenging to navigate the process on their own. In this article, we will understand Form 16—a crucial document provided by employers which is then used for filing your income tax on the portal. Form 16 serves as a certificate that outlines the tax deducted at source by the employer and is submitted to the Income Tax Department. It contains comprehensive information about the payments made to the employee and the corresponding taxes deducted and paid by the employer to the Income Tax Department on behalf of the employee.

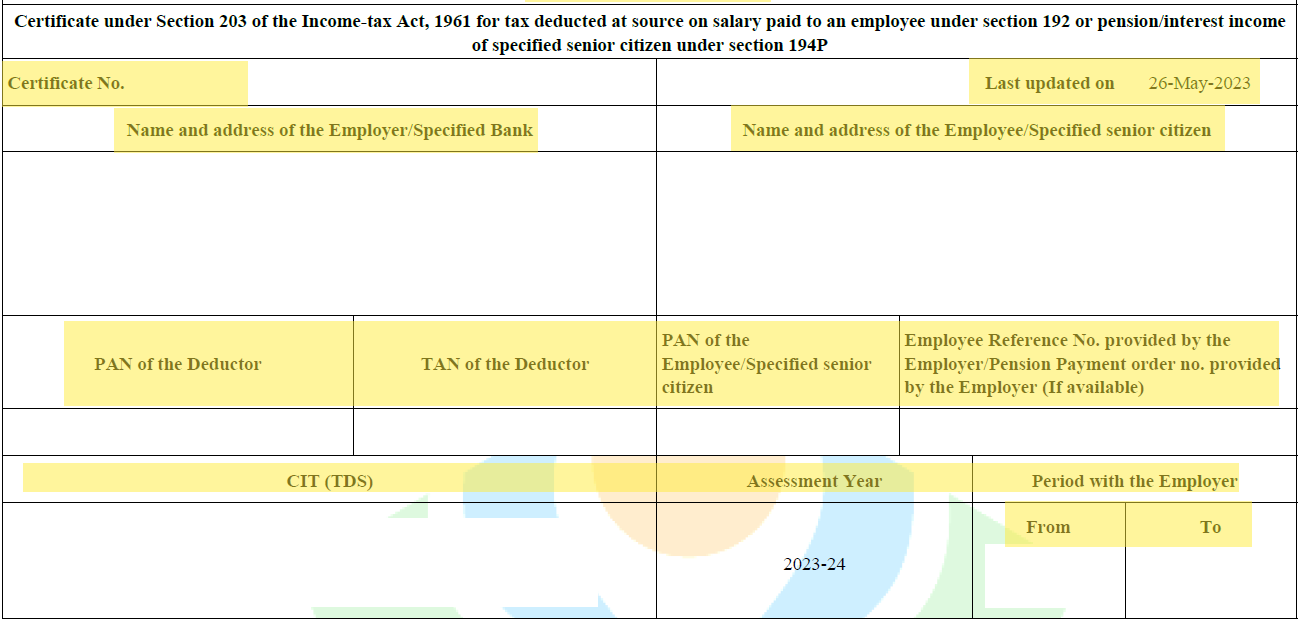

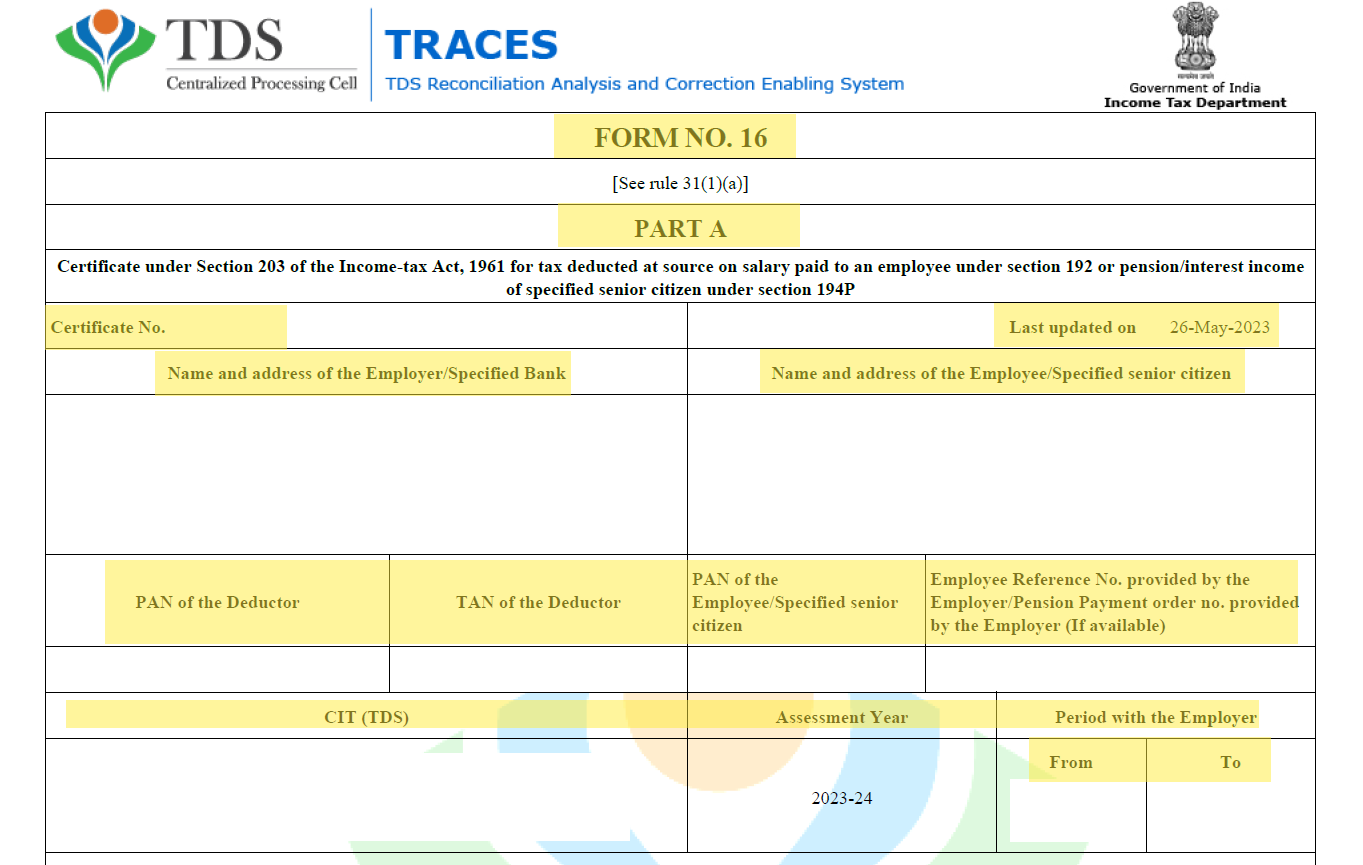

Form 16 basically consists of two parts: Form 16 Part A and Form 16 Part B. Before we explore the contents of each part in detail. Let us see the common section that is available in both Part A and Part B.

Figure 1, illustrates the section common to both Part A & B and this section provides the details of both the employer and employee. The details are as follows:

Part A of Form 16 provides the details about the amount paid by the employer to the employee and the corresponding tax deducted and deposited to the Income Tax Department. Part A is further divided into two sections. The first section is a summary of the amount paid or credited to the employee and the tax deducted at source on this amount. This summary is arranged in a quarterly format, as illustrated in the figure below:

| Quarter(s) | Receipt numbers of original quarterly statements | Amount Paid/Credited | Amount of tax deducted (Rs.) | Amount of tax deposited/remitted (Rs.) |

|---|---|---|---|---|

| Quarter 1 | ABC1234 | 100,000.00 | 10,000.00 | 10,000.00 |

| Quarter 2 | DEF5678 | 120,000.00 | 12,000.00 | 12,000.00 |

| Quarter 3 | GHI9012 | 150,000.00 | 15,000.00 | 15,000.00 |

| Quarter 4 | JKL3456 | 110,000.00 | 11,000.00 | 11,000.00 |

| Total | 480,000.00 | 48,000.00 | 48,000.00 |

The table above provides the details of the amount paid by the employer to the employee during each quarter and the corresponding tax deducted from the salary. The "Amount of tax deducted" column represents the amount deducted from the employee's salary, while the "Amount of tax deposited/remitted" column indicates the amount deposited to the Income Tax Department by the employer.

It is important to note that the figures in this table are for illustrative purposes only and may vary based on individual circumstances. The actual values will be specific to each employee's earnings and tax deductions for the respective quarters.

The second section gives the details of the tax deducted and subsequently deposited in the central government account. The transfer of tax amount can be done through either book adjustment or challans, depending on the company’s procedures. However, it is common for most companies to do it through challans.

As shown in the figure, details about the the tax deposited through every book adjustment/challan and the details of the receipt/challan are provided in this section. The "Challan serial number/Receipt No.s" column denotes the unique identification number for each challan or receipt. The "Date" column indicates the date when the payment was made, and the "Tax deposited" column shows the corresponding amount deposited in INR. The last column “Status of matching with OLTAS” could be U for Unmatched meaning the taxes have not been deposited or incorrect particulars have been furnished, P for Provisional meaning provisional tax has been credited and upon verification it shall change to F, F for Final meaning the payment details have matched or O for overbooked meaning the payment details have matched but the amount is over claimed in the statement.

Part B of Form 16 provides detailed information about the salary paid to the employee and the tax deducted on this salary, including any exemptions or deductions if applicable. It also includes information about the employee's chosen tax regime, whether it is as per the new regime or the old regime, as indicated in Section 115BAC. The employee can find their tax regime option under Annexure I in Part B of Form 16. If "Yes" is indicated for “Whether opting for taxation u/s 115BAC”, it means the employee has opted for the new tax regime; otherwise, it indicates the old regime.

Part B of Form 16 consists of 19 heads, each of which plays a significant role in computing an employee's taxable income. However, it is important to note that not all heads may be filled by the employer. Employers will only include those heads for which employees have made declarations or provided the necessary information. If certain components are not filled by the employer, employees are responsible for declaring them during their tax returns and subsequently claiming any applicable rebate or paying any excess taxes. Let us now start exploring each of these heads beginning with head 1.

The Gross Salary head gives you the in detail salary paid by the employer during the Financial year along with any other benefits both monetary and non-monetary extended to you as part of your CTC. The table below gives you the details about what these constitute of.

| Head No. | Head Name | Sub Section No. | Sub Head Name | Explanation |

|---|---|---|---|---|

| 1. | Gross Salary | (a) | Salary as per provisions contained in section 17(1) | Salary is defined as any amount received by the employee from his/her employer in the form of:

|

| (b) | Value of perquisites under section 17(2) (as per Form No. 12BA, wherever applicable) | The perquisities under this heading can generally be divided into monetary perquisities or non-monetary perquisities: Monetary perquisities are given in the form of cash by the employer. Examples: Medical expenses, Educational expenses, Electricity remuneration, travel expenses etc Non monetary perquisities are benefits given not in the form of cash. Examples: Rent-free accommodation. |

||

| (c) | Profits in lieu of salary under section 17(3) (as per Form No.12BA, wherever applicable) | These could be any pending payments received either before joining or after the termination of your employment or any payment received from unrecognized provident fund/superanuation fund. | ||

| (d) | Total | This is the total of the above three components 1 (a) + 1 (b) + 1 (c) | ||

| (e) | Reported total amount of salary received from other employer(s) | The amount you would have received from any of your other employers either current/previous ones. |

For the purpose of calculating taxable income there are three sections under which you can reduce your gross salary. One such head is Section 10 available in the income tax act. Any income falling under the specified exemptions mentioned in Section 10 is not subject to taxation. The purpose of these exemptions is to provide relief to taxpayers and promote certain activities or investments. The table gives you all the details pertaining to this head.

| Head No. | Head Name | Sub Section No. | Sub Head Name | Explanation |

|---|---|---|---|---|

| 2. | Less: Allowances to the extent exempt under section 10 | (a) | Travel concession or assistance under section 10(5) | Tax on leave travel allowance is exempted for a certain amount. This ceiling is mentioned in the salary of an individual. Also, any expenditure incurred by the employee on transfer is also included under this heading. |

| (b) | Death-cum-retirement gratuity under section 10(10) | As per the voluntary retirement scheme an amount of Rs 5 Lakh INR is exempt from tax upon retirement/death. | ||

| (c) | Commuted value of pension under section 10(10A) | Under this section, tax exemption is applied on money accumulated through pension. | ||

| (d) | Cash equivalent of leave salary encashment under section 10(10AA) | If leaves are encashed by a government employee at the time of resignation, they are non-taxable. If leaves are encashed by a private employee or a government employee during his service, it will be taxed as per their salary slab barring the lowest of these exemptions: |

||

| (e) | House rent allowance under section 10(13A) | Employees are eligible to claim exemption for House Rent Allowance (HRA) based on the lowest of the following three categories:

|

||

| (f) | Amount of any other exemption under section 10 | Any other exemption under section 10 of the income tax guidelines. A separate form is to be filled and signed by the employer if applicable. | ||

| (g) | Total amount of any other exemption under section 10 | The total amount for all the “other” exemptions under section 10. | ||

| (h) | Total amount of exemption claimed under section 10 | This is the total amount of the components 2 (a) + 2 (b) + 2 (c) + 2 (d) + 2 (e) + 2 (g). |

This head gives you the net taxable income after excluding the eligible exemptions under section 10 from your gross salary. This can be calculated as given below:

Total amount of salary received from current employer = Total of Gross Salary - Total amount of exemption claimed under section 10 = 1 (d) - 2 (h)

Section 16 under the income tax act provides deductions on your gross salary under three sub heads: Standard deduction, entertainment allowance & reimbursement of professional tax. The details are provided in the table below:

| Head No. | Head Name | Sub Section No. | Sub Head Name | Explanation |

|---|---|---|---|---|

| 4. | Less: Deductions under section 16 | (a) | Standard deduction under section 16(ia) | As per this head, a standard deduction of a maximum of Rs. 50,000/- is allowed to be removed from your income before calculating the tax. |

| (b) | Entertainment allowance under section 16(ii) | Applicable only for government employees. Private employees cannot claim entertainment allowance exemption even if the employer provides such an allowance. For government employees the exemption allowed is the minimum of:

Note: It is based on the amount received in your salary as entertainment allowance but not based on your spendings for entertainment. |

||

| (c) | Tax on employment under section 16(iii) | A professional tax is levied on your salary income by the state government. A deduction under this head is available only in the year when this tax is paid. There are no limits under this header, whatever professional tax has been paid can be deducted here. |

This head basically gives you the net deductions under section 16.

Total amount of deductions under section 16 = Standard deduction under section 16(ia) + Entertainment allowance under section 16(ii) + Tax on employment under section 16(iii) = 4 (a) + 4 (b) + 4 (c)

This head gives you the net taxable income of all your reported salaries after excluding the eligible exemptions under section 10 and 16 from your gross salary.

Income chargeable under the head "Salaries" = Total amount of salary received from current employer - Total amount of deductions under section 16 = 3 + 1(e) - 5

This head deals with any additional income that you might have accrued during the financial year. It could range from income from rent from house property to interest on savings account/fixed deposits. The details of these are given below in the table.

| Head No. | Head Name | Sub Section No. | Sub Head Name | Explanation |

|---|---|---|---|---|

| 7. | Add: Any other income reported by the employee under as per section 192 (2B) | (a) | Income (or admissible loss) from house property reported by employee offered for TDS | Any income arising from giving your property for rent should be added here. Also, an employee can claim deduction for the interest paid on his/her home loan upto a maximum of 2 Lakhs per Financial year under this section. |

| (b) | Income under the head Other Sources offered for TDS | Interest earned under savings account, fixed deposits, recurring deposits, dividend from shares or income from letting out machinery/equipment for rent or any gifts received that exceeds Rs. 50,000/- per financial year. |

This is the sum of Income from house property and Income under the head other sources as mentioned in section 192(2B) which was explained above.

Total amount of other income reported by the employee = Income (or admissible loss) from house property reported by employee + Income under the head Other Sources = 7 (a) + 7 (b)

The gross total income is given by:

Gross total income = Income chargeable under the head "Salaries" + Total amount of other income reported by the employee

Chapter VI-A of the income tax act is designed to encourage savings, investments and certain expenses while providing relief to the tax payers. This id one by reducing the gross total income for the investments/expenses made under this head. The details are given in the table below:

| Head No. | Head Name | Sub Section No. | Sub Head Name | Explanation |

|---|---|---|---|---|

| 10. | Deductions under Chapter VI-A | (a) | Deduction in respect of life insurance premia, contributions to provident fund etc. under section 80C | An employee can claim exemption for tax for the amounts incurred due to life insurance premium (minimum 5 years holding period), investment in public provident fund, repayment of home loan (principal), investment in post office time deposit scheme (minimum 5 years holding period), senior citizen saving scheme (minimum 5 years holding period) etc with a maximum deduction allowable of Rs. 1,50,000 /- including section 80CCC and 80CCD. Keep in mind that the LIC policy must be in the name of tax payer or his/her spouse or the children and the deduction allowed would be 20% of the sum assured for policies before 31-3-2012 and 10% of the sum assured for policies after 01-04-2012. Also, the deduction would be 15% for policies after 01-04-2013 for a disabled person. Note: It is on the sum assured but not on the premium paid. |

| (b) | Deduction in respect of contribution to certain pension funds under section 80CCC | An employee can claim deduction for any policy purchased that pays pension from the accumulated funds. Note: The maximum deduction possible is Rs. 1,50,000 for 80C, 80CCC and 80CCD. |

||

| (c) | Deduction in respect of contribution by taxpayer to pension scheme under section 80CCD (1) | An employee can claim deduction for payments made to National Pension Scheme (NPS)/Atal pension yojana. Under 80CCD(1), only the employees contributions are exempt upto a maximum of 10% of salary + dearness allowance. Note: The maximum deduction possible is Rs. 1,50,000 for 80C, 80CCC and 80CCD |

||

| (d) | Total deduction under section 80C, 80CCC and 80CCD(1) | 10 (a) + 10 (b) + 10 (c) Upto a maximum of Rs. 1,50,000. Any amount over Rs. 1,50,000 is not eligible for tax deduction. |

||

| (e) | Deductions in respect of amount paid/deposited to notified pension scheme under section 80CCD (1B) | An employee can claim deduction for payments made to National Pension Scheme (NPS)/Atal pension yojana. Under 80CCD(1B), the employees contributions are exempt above the limit prescribed in section 80CCD(1). The maximum deduction allowed is Rs. 50,000 under this head. |

||

| (f) | Deduction in respect of contribution by Employer to pension scheme under section 80CCD (2) | An employee can claim deduction for payments made to National Pension Scheme (NPS)/Atal pension yojana. Under 80CCD(2), only the employers contributions are exempt upto a maximum of 10% of salary + dearness allowance. |

||

| (g) | Deduction in respect of health insurance premia under section 80D | An employee can claim deductions on health insurance premium paid subject to the below conditions: For both self and parents below 60 years: Deduction of Rs. 25,000 is allowed for premium for self/spouse/children and Rs. 25,000 for premium for the parents. For self below 60 years and parents above 60 years: Deduction of Rs. 25,000 is allowed for premium for self/spouse/children and Rs. 50,000 for premium for the parents. For both self and parents above 60 years: Deduction of Rs. 50,000 is allowed for premium for self/spouse/children and Rs. 50,000 for premium for the parents. |

||

| (h) | Deduction in respect of interest on loan taken for higher education under section 80E | If an employee had taken a loan for education in the past, they can claim deductions on the total interest paid during the financial year. | ||

| (i) | Total Deduction in respect of donations to certain funds, charitable institutions, etc. under section 80G | Depending on the charitable institutes, deductions are allowed at 50% or 100% of the amount donated for charity. To claim the deduction under section 80G, the taxpayer must obtain a receipt or 80G certificate from the institution or fund to which the donation has been made. |

||

| (j) | Deduction in respect of interest on deposits in savings account under section 80TTA | If you remember, under the head of income from other sources the interest from savings account was added to the taxable income. However, this is the section where one can claim the exemption for the interest accrued in one’s savings account. |

||

| (k) | Amount Deductible under any other provision (s) of Chapter VI-A | Any other exemption under chapter VI-A of the income tax guidelines apart from the ones stated above. A separate form is to be filled and signed by the employer if applicable. | ||

| (l) | Total of amount deductible under any other provision(s) of Chapter VI-A | The total amount for all the “other” exemptions under chapter VI-A. |

This head gives you the total of all the eligible deductions as per chapter VI-A of the income tax act which was explained under the previous head.

Aggregate of deductible amount under Chapter VI-A = 10 (d) + 10 (e) + 10 (f) + 10 (g) + 10 (h) + 10 (i) + 10 (j) + 10 (l)

Heads 1-11 gave us insights about the possible income and the deductions for saving tax. Heads 12 - 19 are all mentioned in the table below and can easily be calculated based on the explanation given.

| Head No. | Head Name | Explanation |

|---|---|---|

| 12. | Total taxable income (9-11) | Gross total income - Deductions under Chapter VI-A |

| 13 | Tax on total income | Tax as calculated as per your eligible slab |

| 14 | Rebate under section 87A, if applicable | Applicable if your total taxable income doesn’t exceed Rs. 5 Lakhs during the Financial year. The maximum rebate is Rs. 12,500/- |

| 15 | Surcharge, wherever applicable | Applicable for employees with greater than 50 Lakhs income. of the income tax payable. Marginal relief will be provided to people just exceeding these slabs. |

| 16 | Health and education cess | 4 % of the tax payable |

| 17 | Tax payable (13+15+16-14) | Total of Tax on total income + surcharge + health and education cess - Rebate |

| 18 | Less: Relief under section 89 (attach details) | If an employee has received salary advance or arrears/family pension in arrears they can claim relief under section 89. Form 10 E must be submitted before filing the returns. |

| 19 | Net tax payable (17-18) | Tax payable - Less: Relief under section 89 |

These are the essential details one must know about Form 16 before beginning to file their income tax returns. It is important to note that not all the heads mentioned above may be filled when your employer provides you with Form 16. Only those heads will be filled which you have declared to your company. It is advisable to declare as much as possible at the beginning of the financial year to your employer to make the filing process easier. However, even if certain details are not declared, you can still file your returns as long as you have all the necessary information. In the next article, we will explore how to file your returns on the portal using Form 16.

Thumbnail Image Reference: Credits: Indialends